Content

Even before your QBI deduction kicks in, you can lower your taxable income off the bat by keeping thorough expense records throughout the year. That way, you’ll know what you can write off. If you have both types of income, these QBI benefits actually stack. For example, if you have a sole proprietorship for your freelance work and also receive qualified dividends from an REIT, you can deduct 20% from your freelance income and 20% from your REIT dividends.

Many companies will want to know what can be done regarding employee wages since they may limit the QBI deduction. If the same services can be provided by an independent contractor, instead of an employee, then the amount paid to the independent contractor can potentially be a larger part of the QBI deduction. The issue of properly classifying workers as independent contractors versus employees has been an IRS hot topic for years, and is sure to come under more scrutiny with the new rules. The QBI is an excellent tax deduction for small business owners with pass-through income and is essential to understand both from the business and tax savings perspective, as well as when considering your retirement plan.

How to claim the home office deduction

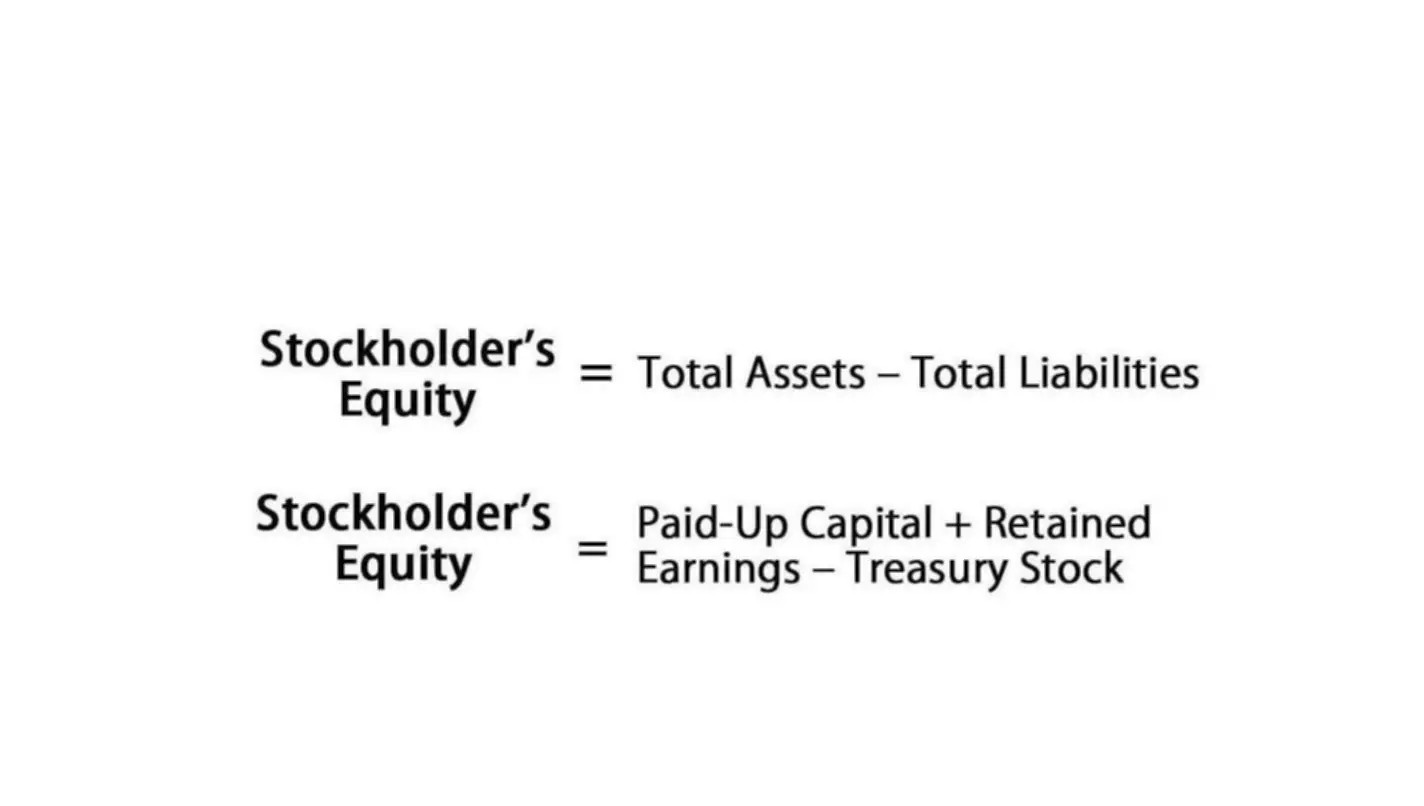

A pass-through business is a sole proprietorship, partnership, LLC or S corporation. The term “pass-through” comes from the way these entities are taxed. Unlike a C corporation, which pays corporate income taxes, a pass-through entity’s business income “passes through” to the owner’s individual tax return. In other words, the business passes through its income and deductions to the owners.

Whether you’re a real estate investor, a freelancer, or the owner of an LLC, you’ll need to understand not only how your personal taxes work but how your business plays into the money you owe the IRS each year. Items not properly includible in income, such as losses or deductions disallowed under the basis, at-risk, passive loss or excess business loss rules. Receive 20% off next year’s qualified business income deduction tax preparation if we fail to provide any of the 4 benefits included in our “No Surprise Guarantee” (Upfront Transparent Pricing, Transparent Process, Free Audit Assistance, and Free Midyear Tax Check-In). Description of benefits and details at hrblock.com/guarantees. Such regulations shall be based on the regulations applicable to cooperatives and their patrons under section 199 .

How is the qualified business income deduction calculated?

When self-employed people put money into their 401s, the amount they contribute can be deducted from their business income. But because taking that deduction lowers their business income, it also lowers the amount of their QBI write-off. After all, 20% of $40,000 is less than 20% of $50,000.